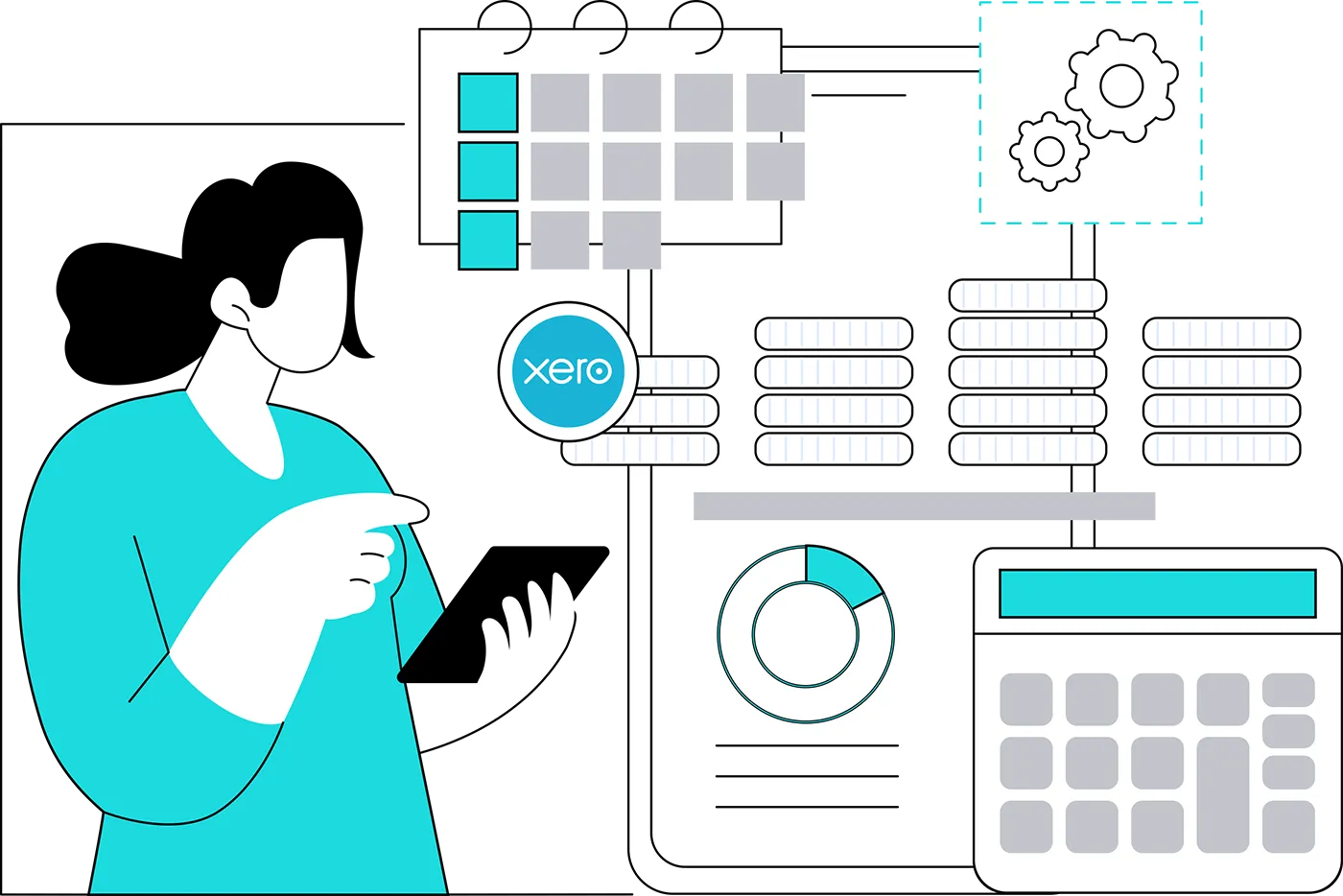

Running a business means wearing a lot of hats – but “payroll expert” doesn’t have to be one of them! We take the headache out of payroll so you can focus on growing your business and supporting your team.

We know that payroll isn’t just about numbers. It’s about making sure your employees are paid correctly, on time, and in line with ever-changing legislation. That’s why we handle the details with accuracy and care, while keeping things simple for you.

Our payroll support covers everything you need to keep your business running smoothly:

Because you deserve more than just number-crunching...

We’ll start with a quick conversation to understand your business, your team, and how you’d like payroll to run. No jargon – just a friendly discussion about what you need.

We’ll handle the setup with HMRC, get your payroll system in place, and make sure all the right details (like employee info, tax codes, and pension schemes) are ready to go.

From your very first pay run, we’ll take care of everything – from calculating wages and tax to sending payslips and filing with HMRC.